can i get a mortgage if i didn't file a tax return

Can i get a mortgage if i didnt file a tax return Sunday March 20 2022 The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any. Up to 25 cash back The tax law says that the home mortgage interest deduction must be cut in half in the case of a married person filing an individual return.

Faqs On Tax Returns And The Coronavirus

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

. Ad Americas 1 Online Lender. This can be done whether or not your. Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate.

Tips Make sure you have several years of tax return forms availabel for review before you. Ad Highest Satisfaction for Mortgage Origination. Generally lenders request W-2 forms going back at.

Apply Now To Enjoy Great Service. In other words a married. Compare Rates Get Your Quote Online Now.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. On the Mortgage deduction summary screen click Add a lender. Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today.

Our 4 step plan will help you get a home loan to buy or refinance a property. However there are mortgage options for people who cannot provide tax returns. Customized for your unique needs.

The 4506 document authorizes the lender whom youre applying with to obtain copies of your tax. There are many instances and different loan products that do NOT call for tax returns. Compare Rates Get Your Quote Online Now.

Youre entitled to deduct only the mortgage interest that you personally. Ad 2022s Online Mortgage Reviews. Once you are in your tax return type mortgage interest into search box on blue dashboard.

The mortgage cant be in someone elses name unless its your spouse and youre filing a joint tax return. Loan approvals may be delayed if you havent filed your return. Ad Get a loan without standard income documentation such as W2s pay stubs or tax returns.

Purchase or refinance with 100 gift funds accepted. Comparisons Trusted by 45000000. In the mortgage process lenders ask you to fill out a document called a 4506.

Ad Americas 1 Online Lender. If you are someone who is contemplating the purchase of a home but have not filed your taxes or have missed the extension deadline have no fear. Borrowers that have not filed their income taxes do not qualify for FHA insurance.

Not providing tax returns for getting a mortgage is not a recipe for granting a loan to consumer who has not filed a tax return. If your taxable income is significantly lower than your gross annual income a. You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history.

For example financial institutions and mortgage lenders may require income verification that includes. Can you get a mortgage without tax returns. Most people assume that you cannot get a mortgage unless you provide your tax returns for the last two years.

If you file your taxes now. Lenders may be able to help you determine whether a no tax return mortgage is right for you. Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS.

Other scenarios include if you are not legally.

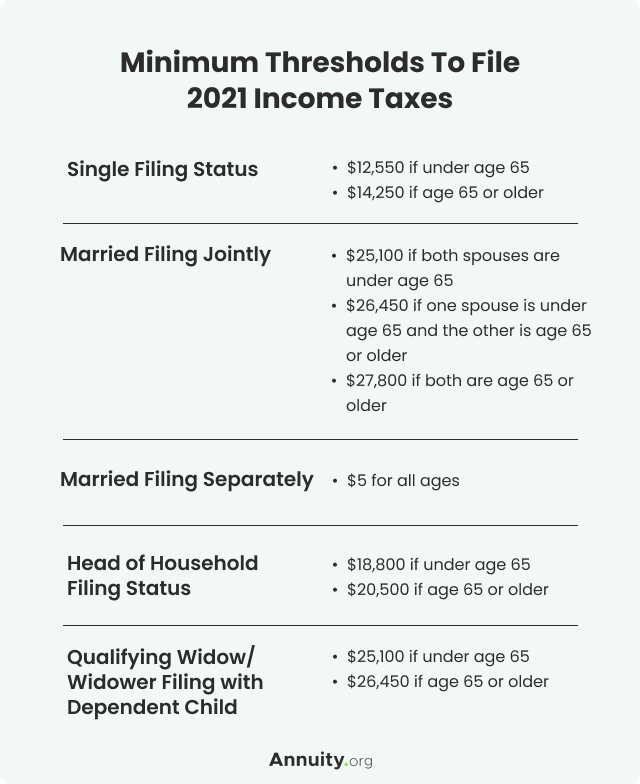

Do You Need To File A Tax Return In 2022 Forbes Advisor

2022 Filing Taxes Guide Everything You Need To Know

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

The Irs Made Me File A Paper Return Then Lost It

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

What Happens If I File My Taxes Late Penalties And Interest As Usa

Here Are Some Last Minute Tips As The April 18 Tax Filing Deadline Nears

Don T Normally File A Tax Return You May Be Due A Credit A Refund Nonetheless

Filing Taxes For Deceased With No Estate H R Block

Why Teenagers Should File A Tax Return Money

2022 Filing Taxes Guide Everything You Need To Know

How To Qualify For Free Tax Filing Forbes Advisor

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

You Should File A Tax Return Even If You Have Little To No Income Forbes Advisor

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs

Where S My Refund Taxpayers Still Waiting For 2020 Irs Return Abc11 Raleigh Durham

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition